Invest

A Select Portfolio

The Portuguese market has been performing well and continues to offer attractive investment opportunities.

The EQTY Capital Fund provides access to off-market properties from leading Real Estate Developers, providing enhanced returns through capital gains.

It is a diversified fully-managed, multi-asset portfolio by asset type, geography and exposure to a Sovereign Wealth backed European Venture Fund.

- Investment from €100k into a Regulatory approved Private Equity Fund at lower cost than traditional real estate and with significant tax benefits

- €500k Eligible for Golden Visa, Permanent Residency, and Citizenship. Fixed investment term that aligns with the Golden Visa timeline

- Strict governance, fully transparent, regulated and tax efficient vehicle.

- Experienced, diverse management team with a strong track record and reputation whose interests are aligned with the investors

- Low annual management fees paid from annual dividends and a high profit share for investors on exit

- Dedicated Digital Investment Platform with an end-to-end service offering including Golden Visa and any assistance in moving to Portugal (launching 2021).

EQTY

Funds

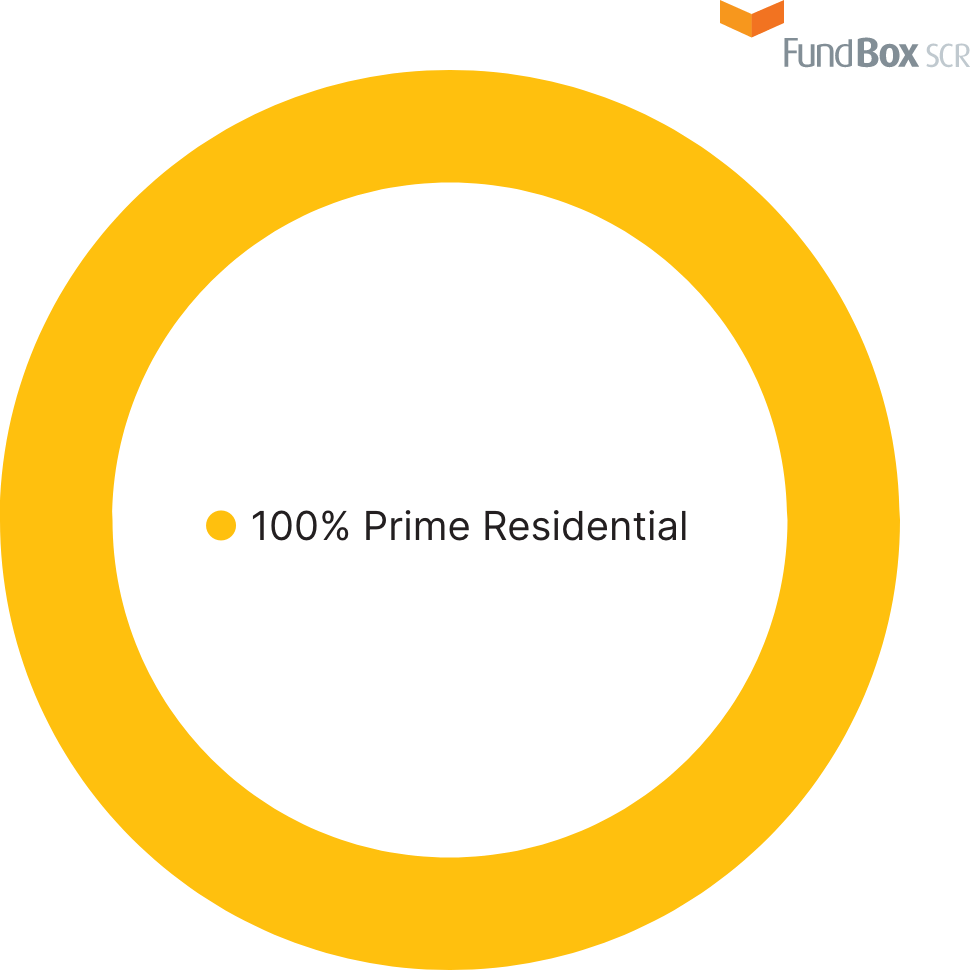

EQTY Capital Fund I

Sub-Fund I

Prime Residential

- Prime residential units of various apartments, villas and townhouses, delivered by Portugal’s leading Property Developers with strong track records.

- Off plan units and refurbishments located in highly sought after areas with yields mostly from long term tenants.

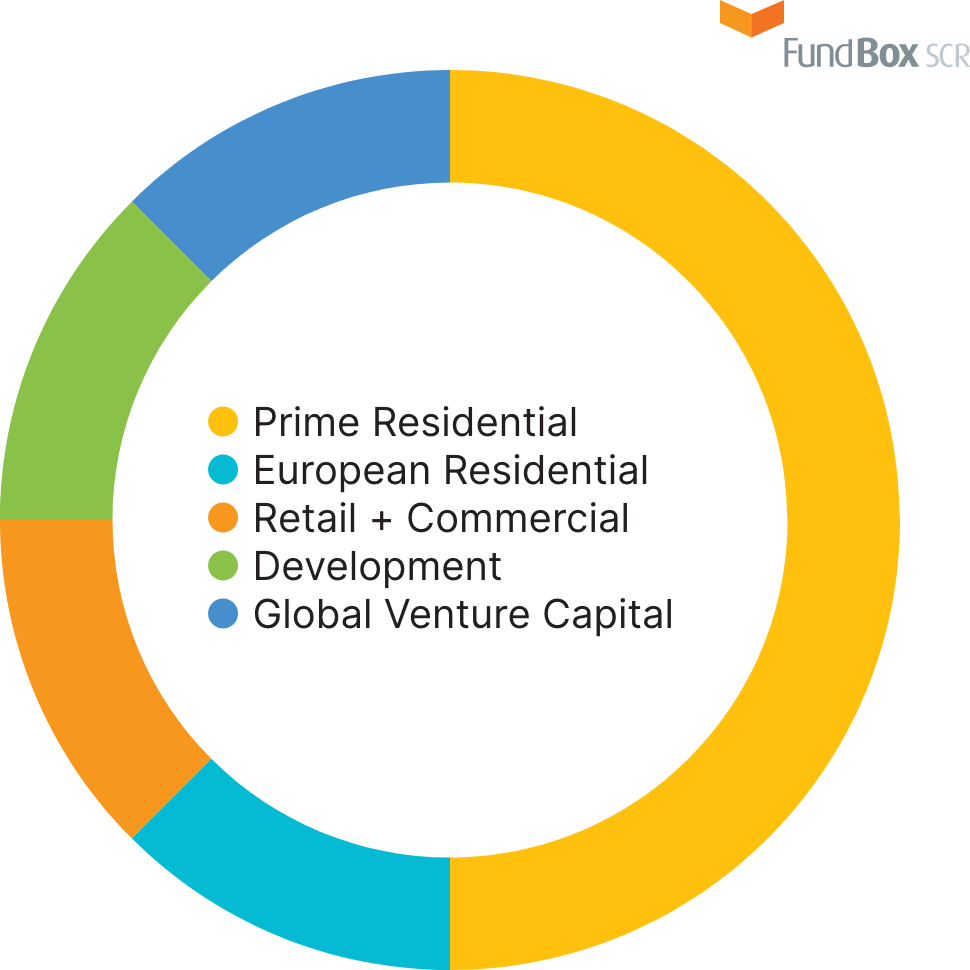

EQTY Capital Fund I

Sub-Fund II

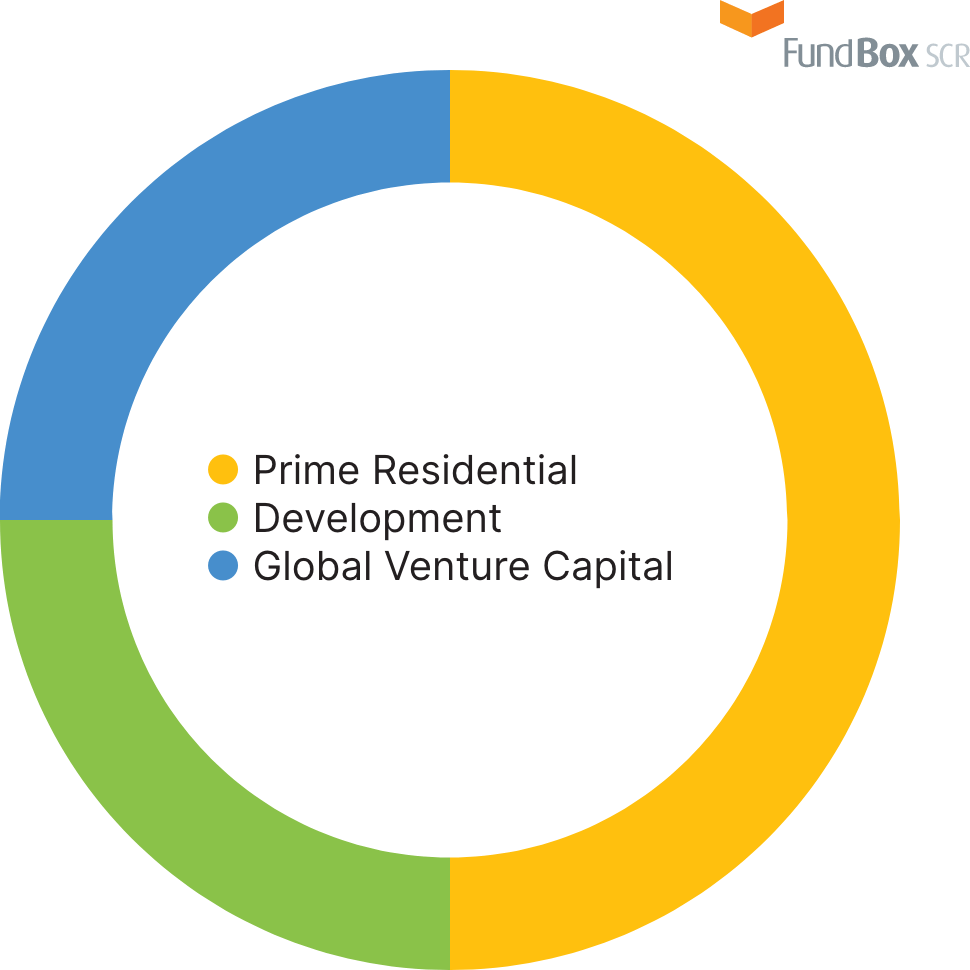

Balanced Portfolio

- The Balanced Portfolio co-invests into the same Residential Units as Prime Residential sub-fund.

- A Nation wide roll out of a European Retail group is in final negotiations, the specific details will be announced shortly.

- Global Venture Capital investments (round B, C & D) are under review which includes investments across US and Europe.

Fund II

Global Growth

Investments across US and Europe

- An initial residential portfolio investment is expected in April ‘22.

- A Nation wide roll out of a European Retail group is in final negotiations, the specific details will be announced shortly.

- Global Venture Capital investments (round B, C & D) are under review which includes investments across US and Europe.

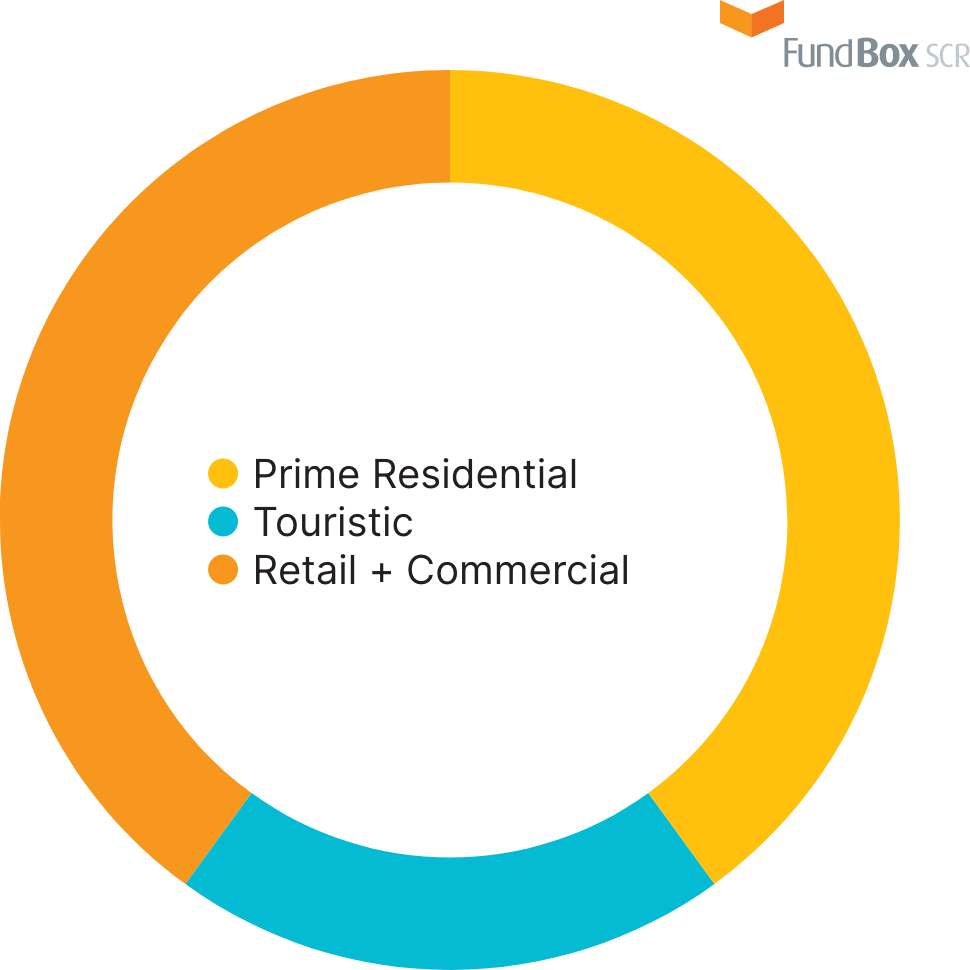

EQTY Capital Fund I

Sub-Fund III

Pure Portugal

- Anchored by prime residential units of various apartments, villas and townhouses.

- Serviced Residence by International Operators.

- Retail + Commercial in Portugal.

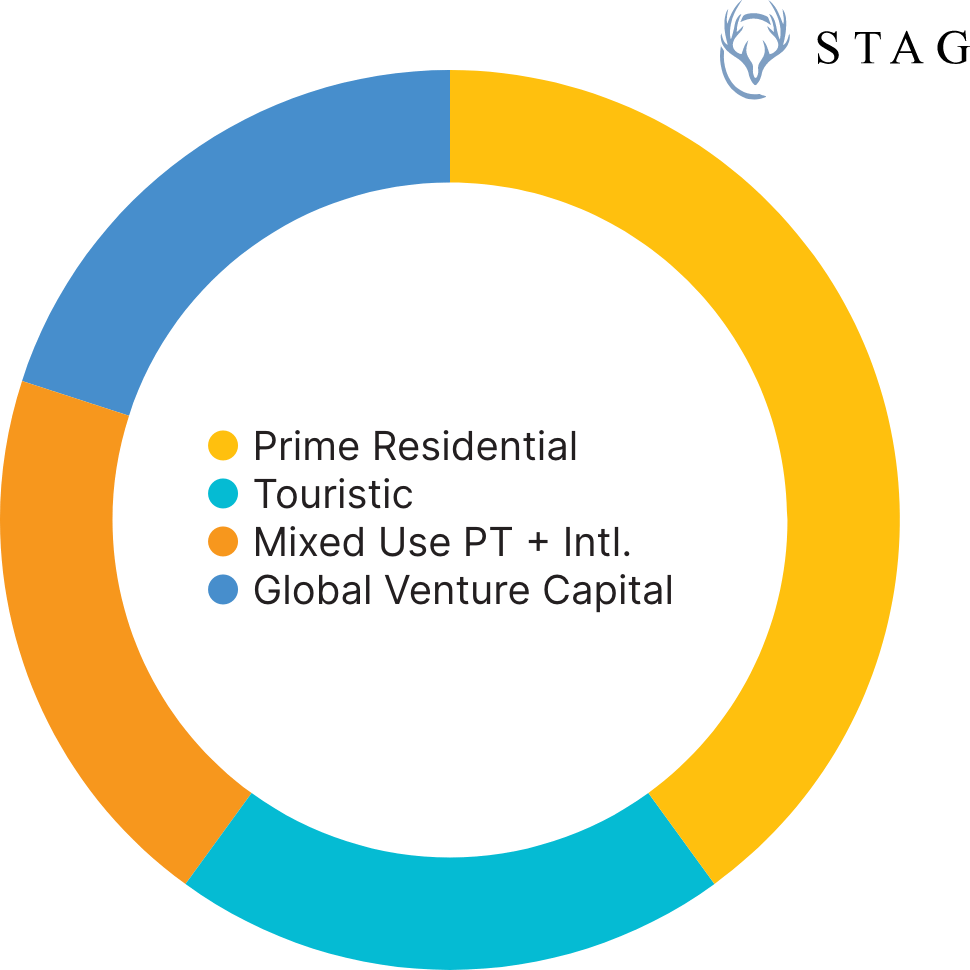

EQTY Capital Fund I

Sub-Fund IV

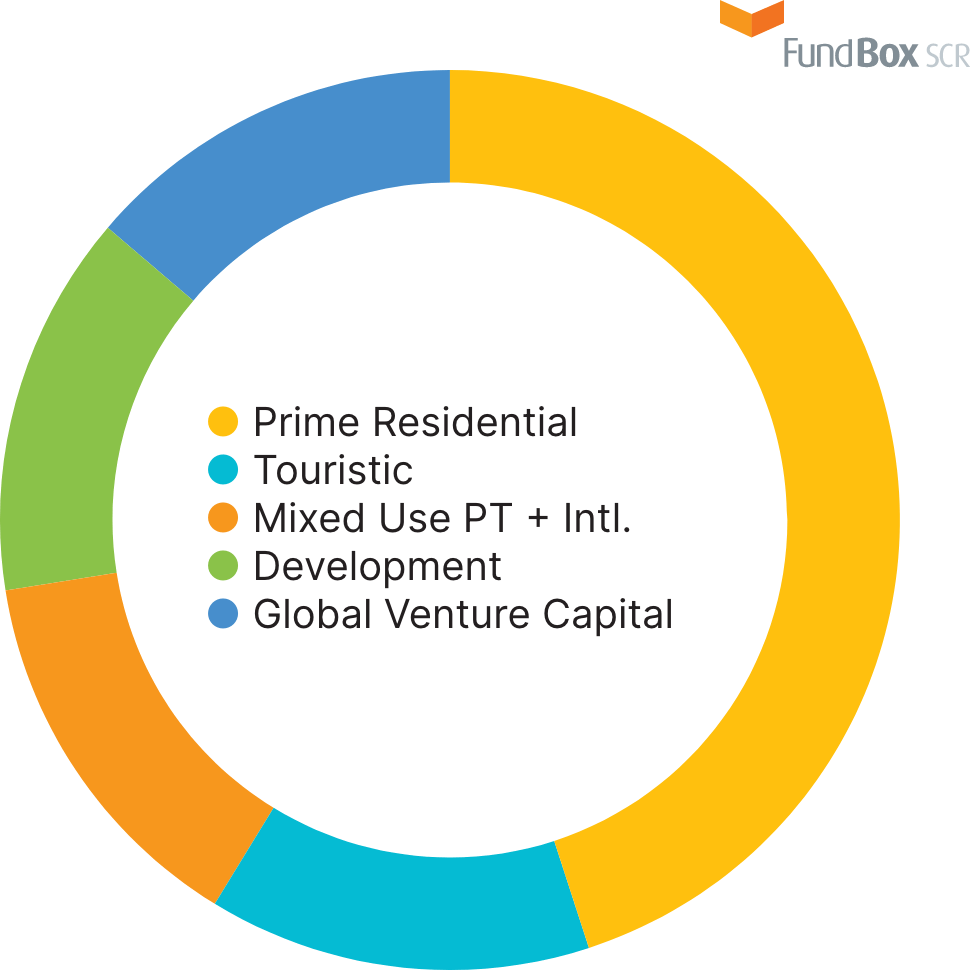

Balanced Plus

- Anchored by prime residential units of various apartments, villas and townhouses.

- Co-Investment with leading Portugal Developers in solid, de-risked projects.

- Co-investment in global venture capital with leading sovereign wealth fund.

Sub-Fund III + Sub-Fund IV

Customised Mix

50% Sub-Fund III + 50% Sub-Fund IV

- Ability to allocate your investment across the various funds to create your own customized portfolio.

- A minimum allocation of €50,000 is required in any one fund.

- The below is an example of a 50/50 split across "Pure Portugal" and "Balanced Plus".

Strong Partnerships

The EQTY CAPITAL FUND provides access to a select and diverse portfolio from Portugal’s leading Real Estate Developers, all with reputations of delivering exceptional properties.

These partnerships provide access to quality real estate opportunities before official release to the general market and offering our investors enhanced returns through capital gains.

Avenue

Bastidor

Besixred

Habitat Invest

Impacto Capital

Krest

LX Capital

Lantia

Libertas

Mexto

Mondego Capital Partners

Odeon Properties

Quantico

RE Capital

Solyd

Square View

Stone Capital

VIC Properties

FUND I

Prime Residential

- Residential properties located in the most sought-after locations in Portugal.

- The units will range from 1 – 4 bedroom apartments, villas and townhouse that are generally high in demand for both sales and rental sectors, meaning choice of long-term tenants and usually very little vacancy.

- These types of properties generally demand higher sales prices and achieve above average capital growth with fairly consistent yields. Assets will include apartments that have short-term rental licenses that are also suitable for long-term tenants.

- We will explore opportunities to acquire and refurbish villas for longer term rental and/ or sale. Townhouses and Villas will be focused on prime/key areas i.e., close to the ocean, schools, convenience stores etc.

- The Properties will typically be purchased off-plan at a market-discount that provides an immediate initial capital growth at acquisition and further growth at completion.

PER €100,000 INVESTMENT

- Yield over 7 yrs.: €20,000

- Capital Gain: €30,000

- Total Gain: €50,000

- Capital Returned: €150,000

- ROI: 50% & IRR of ± 7%

PER €350,000 INVESTMENT

- Yield over 7 yrs.: €70,000

- Capital Gain: €105,000

- Total Gain: €175,000

- Capital Returned: €525,000

- ROI: 50% & IRR of ± 7%

FUND II

Balanced Portfolio

- The Balanced Portfolio will include a 50% allocation to those Prime Residential Properties detailed in Fund I.

- The portfolio will include Retail / Commercial / Education / Industrial assets with sound tenants and long-term leases, that usually offer higher yields and generally lower but stable capital growth.

- Additionally, the portfolio will explore investing into minority stakes of development stage projects with our pre-approved developers where there is a clear and defined exit strategy. These investments are geared for higher capital gain rather than annual yield.

- The fund will include similar residential units in key international markets with attractive yields and growth opportunities balanced with the ability to sell within a reasonable time period. Key cities include but not limited to London, Paris, Berlin, Barcelona, Frankfurt, Prague, Athens etc.

- A portion of the portfolio will be invested into a Sovereign Wealth Fund (SWF) through our strategic partner Freedom Asset Management. The SWF is a €400million high-growth fund focused into early stage Private Equity Ventures across Europe.

PER €100,000 INVESTMENT

- Yield over 7 yrs.: €17,000

- Capital Gain: €46,000

- Total Gain: €63,000

- Capital Returned: €163,000

- ROI: 63% & IRR of ± 8%

PER €350,000 INVESTMENT

- Yield over 7 yrs.: €60,000

- Capital Gain: €160,000

- Total Gain: €220,000

- Capital Returned: €570,000

- ROI: 63% & IRR of ± 8%

EQTY CAPITAL FUND I

GOLDEN VISA PROGRAMME

-

Launch 2021

-

March 2021

Onboarding begins

-

May 2021

Apply for Golden Visa

-

May 2021

Property purchases begin

-

2022

-

May 2022

Subscription period closes

-

May 2022

Residency card

GV 5yr term starts

-

2024

-

May 2024

Golden Visa Renewal 1

-

2026

-

May 2026

Golden Visa Renewal 2

-

2027

-

May 2027

GV 5yr term finish

-

May 2027

Explore initial exit opportunities

-

Jun 2027

P.R. + Citizenship application GV#1

-

August 2027

Permanent residence

-

Early investor exits

-

2028

-

August 2028

Citizenship

-

December 2028

Majority investor exits

-

2029

-

July 2029

Final fund close

Would you like to know more?

Feel free to call us +351 215 950 000 or send a message below.